Tax season can be stressful, not just because of deadlines, but also due to cash flow challenges. Many tax professionals rely on advance loan options to bridge the gap between client refunds and business expenses. But navigating these options can be confusing. This guide breaks down the essentials so you can make smart choices without stress.

What Are Advance Loan Options?

Simply put, advance loans allow tax professionals to access funds before client refunds are issued. Think of it as a short-term cash boost to cover payroll, office expenses, or marketing campaigns.

These options aren’t just for large firms—independent tax pros can benefit too. Understanding how they work ensures you use them effectively and avoid unnecessary fees.

How Advance Loans Work

Here’s a simple breakdown:

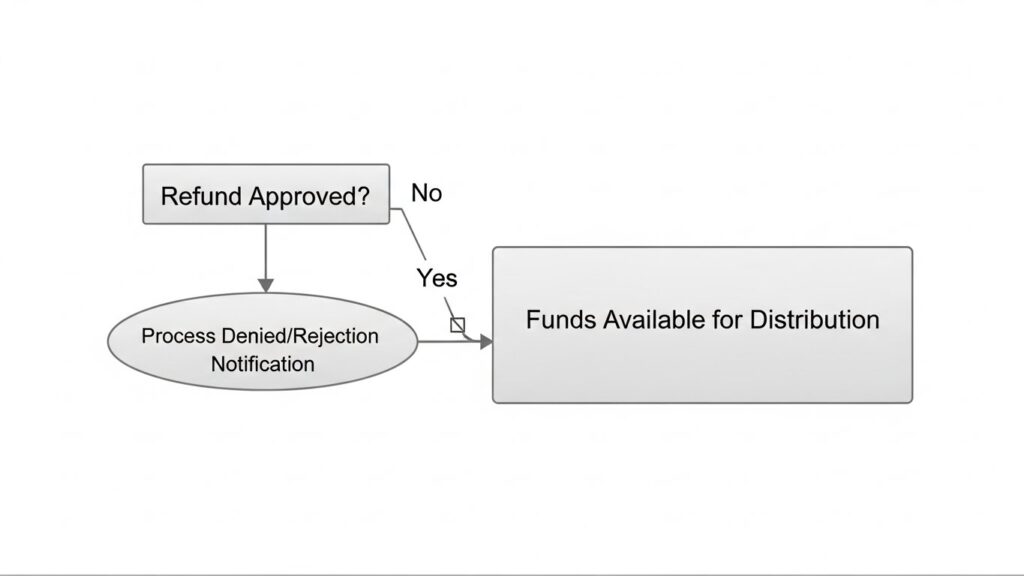

- Client Refunds: Your clients’ tax refunds are processed by the IRS.

- Loan Application: You apply for an advance based on expected refunds.

- Fund Disbursement: Approved loans are deposited into your account before the refund is issued.

- Repayment: The loan is repaid automatically once the IRS releases the client refund.

Tip: Always read the fine print. Fees and interest rates can vary, so choose options that align with your cash flow needs.

Benefits of Advance Loan Options

- Immediate Access to Cash: Cover expenses without waiting for client refunds.

- Business Flexibility: Invest in marketing, office supplies, or temporary staff.

- Peace of Mind: Reduce stress knowing you won’t face cash flow gaps.

For example, imagine you’ve just signed 50 new clients, but your office needs an extra set of staff to handle the workload. An advance loan can cover payroll while ensuring clients’ refunds are safely processed.

Common Misconceptions

- “Loans are risky.” – When used wisely, advance loans can be a safe financial tool.

- “Only big firms qualify.” – Many loan programs cater to independent tax pros.

- “It’s complicated.” – Most providers offer simple application processes and support.

Conclusion

Advance loan options are more than just financial tools—they’re a way to maintain flexibility, reduce stress, and focus on client service during tax season. With careful planning and smart choices, you can ensure your business runs smoothly, even during peak periods.